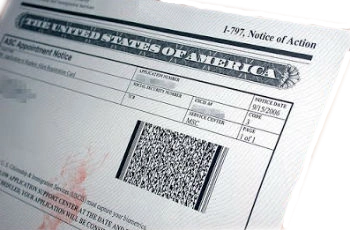

Non-Permanent Resident Program

Access to housing with qualifying work VISA

Conventional

Just because you’re not a U.S. citizen doesn’t mean home ownership is out of reach. Lawful permanent or non-permanent residents can apply for loans just the same as citizens

Clear Lending offers mortgage programs for non-permanent residents that might be right for you.

With the Non-Permanent Resident Program, we can help those professionals working in the US with a valid social security number and evidence of an acceptable visa. Acceptable Visa includes E Series (E-1, E-2, E-3), H Series (H1-B, H1-C, H-2, H-3, H-4), L Series (L-1A, L-1B, L-2), O Series (O-1) and NATO (TN-1 and TN-2).

Provide a copy of the employer's letter of sponsorship for visa renewal if a borrower(s) visa will expire within six months of the loan application, and the borrower has not changed employers.

Get today's lowest mortgages rates.

Non-Permanent Resident program borrowers are still subject to Fannie Mae or Freddie Mac's automated underwriting systems with at least one valid credit score to be eligible.

If you want to purchase your dream house and have any of the permits mentioned above, Clear Lending can help you. Simply apply online, and we will contact you right away to review the best options for you.

Don't wait any longer and find out how much loan you can get Pre-Approved.

Whether you are considering purchasing or refinancing an existing mortgage loan, Clear Lending can help you. Simply complete our secure and encrypted Pre-Approval Form online, and we will contact you right away to review the best options for you.

Not all applicants will qualify. This advertisement is not an offer for an extension of credit. Please meet with a licensed loan originator for more information as programs are available only to qualified borrowers. Programs rates, fees, terms, and programs are subject to change without notice. Not all loans, loan sizes, or products may apply. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet loan-to-value requirements, and final credit approval. Approvals are subject to underwriting guidelines and program guidelines and are subject to change without notice. Some restrictions may apply.

Customers Reviews:

-

Brandon Saavedra • Jule 05, 2023

Joan Gallardo and his team have been great help in the home buying process. They go above and beyond to ensure all questions are answered and all due dates are met. I would highly recommend clear lending to any future home buyer.

-

Rodolfo Garcia • Jule 25, 2018

Joan and the rest of staff at Clear Lending did an amazing job. Taking the time to explain all the details and taking all the right steps on getting me into a home. I recommend anyone in the home buying market to contact him. He will take care of you.

-

Carolyn De Leon • December 22, 2016

Good afternoon Joan, thank you so much for all your hard work and patience during this journey. I know it was not easy but we made it. I hope God continues to use you to help make other people's dreams come true. You and your team have been a blessing to my family. Have a Merry Christmas and a most wonderful and prosperous New Year!!!!! Once again, Thank you and Best Regards Carolyn De Leon