Your Dream Home Isn't Far Away

At Clear Lending, we are driven by our simple motto “Clear Steps, Clear Terms, Clear Loans” offering best home loans in Texas. Best mortgage reviews in Houston expressing clients' satisfaction in finding the right home loan program in unbiased and fair manner at the most attractive rates is the greatest testimony to our hard work.

One Stop for All Home Mortgage Programs

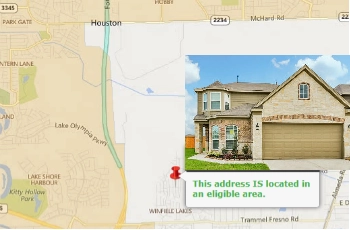

Whether you need a first time home buyer loan program in Texas, VA loan program, rural loan program, investor loan program, second house loan program or any home mortgage loan program our Home Loan Specialist will help you make informed choices. Helping you avail the best home mortgage program at the best mortgage rates is our goal. We take pride in guiding you to become the best mortgage lender in Houston.

Service Highlights

- Free Solution Based Consultation

- Best Purchase Home Loans in Houston

- Best Refinance Home Loans in Houston

- Best Interest Rates in Houston

- Fast pre-approval process

Product Highlights

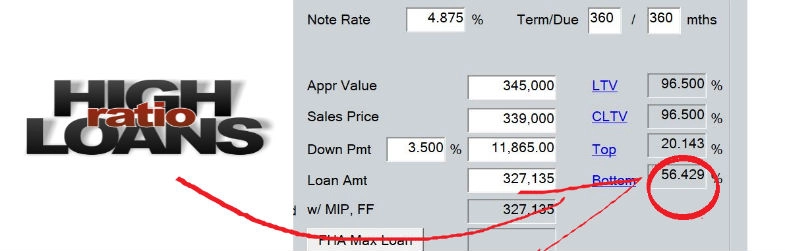

- Home loans for high debt ratios

- Government loans for low credit scores

- VA loans for low credit scores

- VA Jumbo loans

- FHA Loans for low credit scores

- First time buyer home loan programs

- Government Loan Programs in Texas

- Home loans for low credit scores in Houston

- Lowest Mortgage rates in Houston

- Best Mortgage Lender in Houston

Home ownership is an unparalleled experience;

We play a small part in your big dream.