Print Or Share Your Loan Calculation + Amortization With Or Without Extra Payments

How to Use the Mortgage Calculator

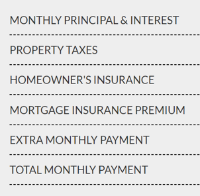

FHA loan calculator in Texas is designed to estimate your monthly payment including the loan principal and interest components, property taxes, private mortgage insurance and homeowner's insurance of your desired mortgage loan program as well as the amortization schedule.

Before introducing the desired Purchase Price please note you must select the program amongst FHA, VA, USDA or Conventional Mortgage Program. Simply click the Program and the FHA Loan calculator's fields become accessible.

As a reminder,

FHA is the low-down-payment first time home buyer program.

VA is the mortgage program available only to active members of the US Armed Forces and their Veterans.

Then USDA is the rural mortgage program tailored for low-income borrowers with no down payment requirement and,

Conventional mortgage program is for borrowers who typically have higher credit scores, income and have access to more funds to close.

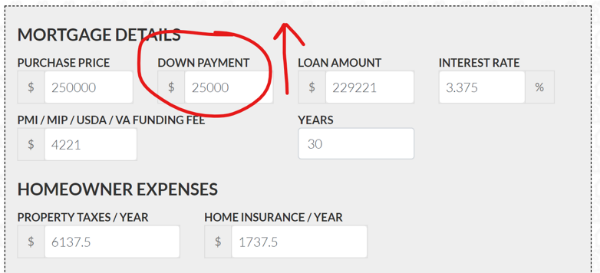

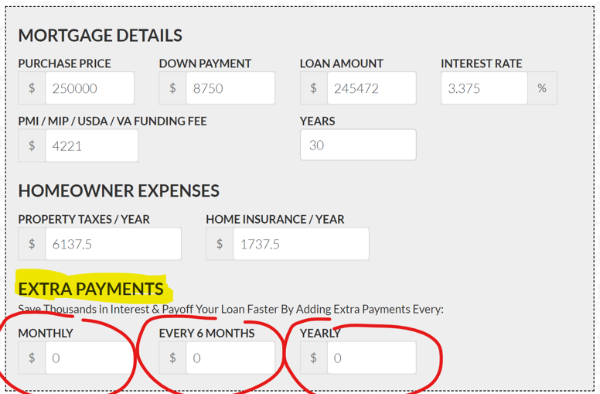

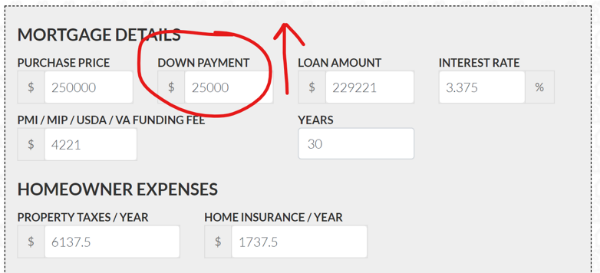

Once the desired program has been selected and FHA loan calculator's fields become accessible, input the desired Purchase Price and click TAB. Please note how all fields are automatically filled based on Program minimum down payment requirements, estimated taxes and insurance for a property in Houston, Chicago, IL & Fairfax County, VA and Texas and its Upfront Mortgage Insurance if the program requires one. Feel free to modify down payment if desired then click TAB to have calculator update results.

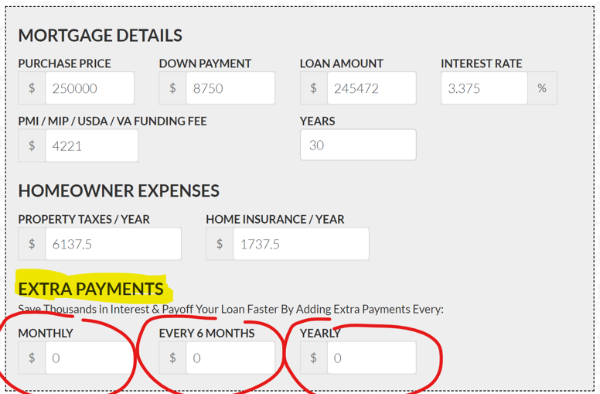

Once we have selected the desired Program, added the Purchase Price and satisfied with its down payment, you can add extra payments on a monthly basis, every 6 months and once a year to find out how many years would you save if decided to pay extra over required minimum monthly payment.