Rural Housing Loan Program

Enjoy 100% Finance & 0% Down Payment with Rural Loans

Rural Housing Service (RHS)

The United States Department of Agriculture aims to help individuals and families with low and very low income realize the dream of affordable home ownership.

Enjoy 100% Finance and 0% Down Payment with Rural Loans in Texas.

No home mortgage matches rural loans in terms of the flexibility it offers. If you live in a designated rural area, at Clear Lending, we will help you avail the benefits of this loan program. The United States Department of Agriculture aims to help individuals and families with low and meager incomes realize the dream of affordable homeownership. It has helped millions of people in rural areas with limited resources. Rural loans in Houston allow eligible borrowers to construct, rehabilitate, or improve their dwellings.

Eligibility Requirements for Rural Loans

•Be a citizen of US, US non-citizen or other Qualified Alien

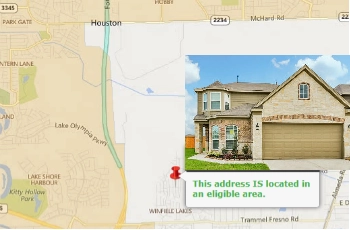

•Property must in a designated rural area

•Have income less than 115% of the median income in the county

•Must occupy the dwelling as a primary residence

•Must have the legal/financial capacity to incur loan obligations

•Should not be suspended or disqualified from participation in federal programs

•Establish will to timely meet credit obligations

Once the loan has been approved, the borrower may use the funds for the following purposes only:

•Purchase new or existing residential property for use as permanent residents. Fund the closing cost and use it for customary expenses for the purchase

•Buy a site with new or existing dwelling

•Expenses on repairs and rehabilitation after the purchase of a present residence.

•Refinancing current home mortgage programs (eligible programs only)

•Structure modification, design alteration, or installing equipment to accommodate members with a physical disability.

•Expenditure on judicious and customary connection fees and assessments or pro rata installment cost on essential utilities, including water, electricity, gas, and sewer.

•Fund pro-rata share of real estate taxes, which are due at the time of loan closing. Also, borrowers can allocate funds to establish escrow accounts for real estate taxes and hazard and flood insurance premiums

•The loan can be used to fund the purchase of household equipment such as refrigerators, heating and cooling equipment, ovens, wall-to-wall carpeting. But all equipment purchased needs to be conveyed with the dwelling.

•Investment in energy-efficient equipment such as solar panels, double-paneled glass, and insulation.

•Installation of fixed broadband lines that are related to the dwelling

•Investment on-site preparation, grading, foundation plantings, sod installation, seeding trees, fences, walls, and driveways.

Wait no more if you want to purchase your dream home under rural loans program and want to know the amount you are Pre-Approved for

At Clear Lending, we shall take every measure to help you purchase or refinance an existing rural loan program. All that you need to do is fill the details in our secure yet straightforward encrypted Pre-Approval Form online, and we shall review it and get back to you with the best options.

Not all applicants will qualify. This advertisement is not an offer for an extension of credit. Please meet with a licensed loan originator for more information as programs are available only to qualified borrowers. Programs rates, fees, terms, and programs are subject to change without notice. Not all loans, loan sizes, or products may apply. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet loan-to-value requirements, and final credit approval. Approvals are subject to underwriting guidelines and program guidelines and are subject to change without notice. Some restrictions may apply.