Credit reports with accounts in dispute.

How do disputed accounts on credit report affect to the chances to qualify for a home mortgage?

Consider this; a credit score not only measures creditworthiness but provides great insight to banks and lenders about the history and thus the ability and intend to payback debts. Scores are calculated by the major credit-rating agencies--Experian, TransUnion and Equifax--based on a number of factors on a credit report, including the number of open accounts, the types of accounts revolving vs installment, available vs used credit and/or the length of credit history.

Your payment history on credit will greatly influence the terms under which you can borrow money to purchase a home. Derogatory credit in the form of disputed accounts may lower your chances to qualify or even be the reason for eliminating your chances to purchase a house.

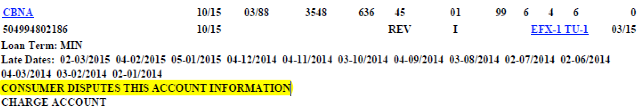

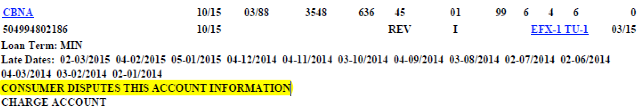

If an applicant's credit report has $1,000+ in disputed derogatory credit accounts, the loan application must be downgraded and manually underwritten meaning your debt to income qualifying ratios will be lower and thus potentially affecting your approval.

Disputed Charged off accounts, disputed collection accounts and/or disputed accounts with late payments in the last 24 months are examples of disputed derogatory credit. Then disputed medical accounts, disputed derogatory credit resulting from identity theft, credit card theft or unauthorized use are excluded from the $1,000+ cumulative balance. To exclude these balances, the Mortgagee must provide a copy of the police report or other documentation from the creditor to verify the status of the accounts.

If none of the reasons above apply then you will be required to remove them from your credit. Banks are aware accounts in dispute do not reflect the negative impact of late payments being disputed on its scores and thus artificially help you obtain higher scores than should be otherwise. This is why underwriters require during the approval process to remove certain accounts in dispute and rescore your credit to obtain the correct real scores.

Disputed Derogatory Credit Accounts of a non-borrowing spouse in a community property state are not included in the $1,000+ cumulative balance for determining if the mortgage application is downgraded.

Also disputed accounts with zero balance, disputed accounts with late payments aged 24 months or greater and disputed accounts that are current and paid as agreed are considered non-derogatory disputed accounts and thus not included in the $1,000+ cumulative balance for determining if the mortgage application is downgraded.

This is why it is so important an experienced loan officer analyzes your credit in detail before accounts in dispute are removed as doing so has a high probability to lower your scores beyond minimum required.

Don't wait any longer and find out how much you can get Pre-Approved for.

Whether you are considering purchasing or refinancing an existing mortgage loan, Clear Lending can help you. Simply complete our secure and encrypted Pre-Approval Form online and we will contact you right away to review best options for you.

This advertisement is not an offer for an extension of credit. Programs available only to qualified borrowers. Programs subject to change without notice. Underwriting terms and conditions apply. Some restrictions may apply.

Customers Reviews:

-

Jackie Sullivan • August 08, 2019

FROM GOOGLE: I worked with Joan at Clear Lending. Joan worked not only as a lender but as a realtor showing me the houses. He communicated with me every step of the way and answered any questions I had. He was honest about the properties we looked at and was very helpful with suggestions for renovations I was interested in. He made suggestions for contractors after I closed on a house who offered fair prices and did exceptional work. Joan will go the extra step for you plus some and I would recommend him and Clear Lending to anyone who is interested in buying a new home. Joan is dedicated and will get the job done! He made my first home buying process enjoyable and easy. His honesty and hard work are appreciated! I have already recommended Joan to friends who have just started looking for new homes.

-

Gerard Porter • December 22, 2021

This place is the real deal if your credit isnt the best. I was denied over old stuff on my credit and after searching on Google I found this company and after reading reviews I gave a shot. It took me 7 months but after following Joan's advise, I have been able to close on my second house. I have closed in less than 45 days and while I had my doubts this would be possible The Man made it happen. Thanks Joan you got a client and a friend. Can thank you enough. I like to extend my gratitude to all his team that are very sweet and professional. Thanks again.

-

Samecia Lawrence • February 23, 2019

FROM GOOGLE: We were first time buyers and did not know how much work it was when purchasing a new home but Joan went above and beyond to get us into our dream home. He educated us on the process, kept us up to date with our account, made himself available day or night if we had questions and was very patient with us. He made an experience that can be tiresome as smooth as possible. Our family is forever grateful for all his hard work and we will definitely refer him and this company to our friends looking to purchase a new home.