Avoid losing your earnest money deposit.

Do you know anyone who lost an earnest money deposit after his/her loan was denied? Unfortunately this is more common than one would wish.

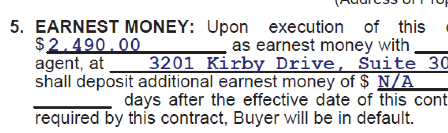

An Earnest Money Deposit is a good faith deposit which should never be confused with a down payment. When buyers execute a purchase contract, the contract states how much money the buyer is putting up solely to secure the contract. An earnest money deposit basically says to the seller you are serious about buying his/her house and thus willing to put your money where your mouth is.

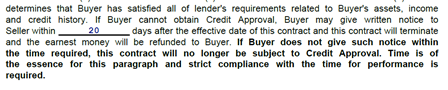

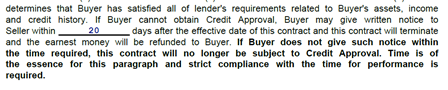

The contract may also specify you have a limited number of days to secure financing and failure to do so by the deadline if your loan is denied earnest money deposit may be lost.

This is why it is highly recommended no matter how confident you think your loan will be approved, that you maximize protection of your earnest money by starting your loan application and submission to underwriting well before you start looking for homes.

It would not be the first time a borrower holding liquid assets for the same amount or even higher than purchase price to his/her surprise mortgage loan is denied.

A mortgage loan approval process takes into consideration a large number of variables borrowers could not possibly imagine or know before applying for a loan.

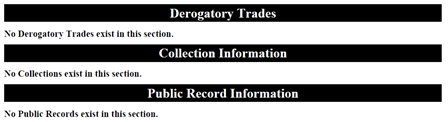

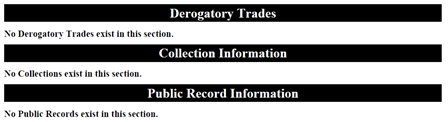

Credit alone presents many challenges such as the number and age of trade lines eligible per guidelines, alerts and validation which may require to pull again credit affecting scores, conflicting derogatory trades, collections or public record information borrower was unaware of, accounts in dispute and so on.

Employment is another area of concern. Are we in need to qualify with just base income or need also any overtime, bonus or commission income? Then do other income components have the minimum required trend?

What about our assets? Are our accounts free from large deposits which will reduce our qualifying cash to close and thus affect our approval? Do we have NSF charges we were not aware of affecting our approval?

Is our loan requiring to include all debts from our husband/wife even though he/she will not be in the loan?

In short, a numberless of questions which if not addressed well ahead of time could lead our “perfect loan” thought to be approved in a heartbeat straight into a denial; And of course probably losing our earnest money deposit.

At Clear Lending we believe a humble approach is the smartest way to secure your earnest money deposit emailing us or making an appointment to bring income/assets documents ahead of time before looking for homes so all areas of concern are cleared.

Don't wait any longer and find out how much you can get Pre-Approved for.

Whether you are considering purchasing or refinancing an existing FHA mortgage loan, Clear Lending can help you. Simply complete our secure and encrypted Pre-Approval Form online and we will contact you right away to review best options for you.

This advertisement is not an offer for an extension of credit. Programs available only to qualified borrowers. Programs subject to change without notice. Underwriting terms and conditions apply. Some restrictions may apply.

Customers Reviews:

-

Nicole Elizabeth • June 05, 2015

Joan was amazing! After being let down by Chase mortgage company, Joan and his team picked up the pieces and helped me out tremendously! I would recommend going through him for loans instead of a big commercial bank. No matter what time of day; he would answer any questions or reached out to me about any concerns. He is with you and the realtor every step of the way to help get you a home. Very passionate about helping clients get a home! I would like to thank Joan and his team for helping me get my first home! Y'all made the home buying process easy for me! Thank you again. I love my home.

-

Edwin Lopez • December 15, 2023

Mi esposa y yo aplicamos para el programa de ITIN nos ayudaron a reunir todos los requisitos y cuando fuimos aprobados tambien ellos nos ayudaron a buscar la casa. Al hacer los 2 tramites aqui nos dieron un credito para nuestros gastos de cierre. Joan y a su equipo muchas gracias.

-

Sue Ann Lee • Jule 03, 2024

They have great customer service skills being available at all times. Joan advised me to go with an FHA loan program as the best option for first time buyers. I got a really good deal and smooth transaction. I truly recommend them.