Home loans for high debt ratios

Are you finding it hard to complete the purchase on your home due to high debt? Has your bank recently depressed you and your family from buying that perfect house because of overlays over too much debt or past financial issues? If the answers to these questions are YES maybe you need to seek a home loan for high debt ratios.

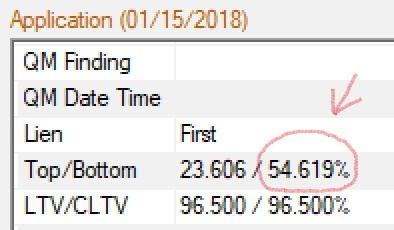

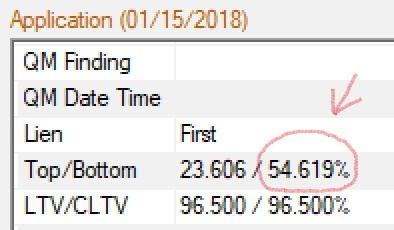

Debt-to-income ratio shows how much of a percentage of your income you are paying towards your debt each month. High debt-to-income ratio means that a larger part of your income goes towards paying off your debt each month while a lower ratio means a smaller portion of your income is spent on paying off debt.

Those planning on purchasing a home will find getting approved for home loans for high debt ratios is almost out of reach. Next, we will share 3 tips that will help you qualify for home loans for high debt ratio. It’s important, however, to remember that each and every lender has their own different lending requirements also called overlays, therefore each will analyze an applicant’s debt-to-income ratio differently.

To increase your chances of qualifying for a home loan, let’s take a look at how you can overcome your debt-to-income ratio and qualify to purchase that dream home!

1. Create A Plan - Unless you have a dire need to purchase a home and you cannot wait, we suggest that you contact us first seeking advice on which accounts to invest extra payments to reduce your debt ratio. Believable or not it makes a difference the order paying off student loans, credit cards, car payments, furniture or any other type of loans whether installment or revolving accounts. In an ideal scenario, having a debt ratio under 36% can increase your chances of qualifying for a home loan even though we have approved loans woth ratios over 50%.

2. Increasing Down Payment - Although paying a large down payment might not be a viable option for some applicants, it is something that if possible we suggest. Borrowers with IRAs or other retirement accounts need to consider the savings in interest and PMI expense vs increase in value of such assets. Not only may be a good investment but show the lender the seriousness of your decision of purchasing a home as well as indicating your commitment towards the investment, thus increasing your chances of qualifying for home loans for high debt ratio.

3. Government Assistance - If you find that home loans for high debt ratios is not an option that is available to you with private lenders, then turning to government home loan programs is the best possible option for you. These home loan programs were designed and developed by the government to promote homeownership by providing financial assistance to those unable to purchase a home through any other means due to lack of financial availability or a good credit history.

Created by the Federal Housing Administration, the FHA home loan is issued by approved FHA lenders and provides the following benefits:

* FHA loans allow the borrower to get approval for the home loan despite high debt ratio.

* You can purchase a home with down payment as low as 3.5%.

* There is lower mortgage insurance with a FHA loan.

* The FHA provides better interest rates compared to other home loans.

At Clear Lending, we will conduct a free analysis of your ratios helping you understand your chances of qualifying for home loans for high debt ratios. Simply contact us and we will help you with best plan to purchase your dream home.

Don't wait any longer and find out how much you can get Pre-Approved for.

Whether you are considering purchasing or refinancing an existing mortgage loan, Clear Lending can help you. Simply complete our secure and encrypted Pre-Approval Form online and we will contact you right away to review best options for you.

This advertisement is not an offer for an extension of credit. Programs available only to qualified borrowers. Programs subject to change without notice. Underwriting terms and conditions apply. Some restrictions may apply.

Customers Reviews:

-

Jason Park • November 16, 2015

Joan makes you feel you are his only customer. And he doesn't seem to sleep either. Always speaks with kind works with us. Thank you again Joan.

-

Javier Rodriguez • November 05, 2015

BEST LOAN OFFICER!!! I had a terrible experience with Nations Reliable Lending. After wasting time, I met Joan Gallardo. He cleaned my credit explaining WITH details what had to be done. He worked day, nights, even on SUNDAYS on getting me approved. Who does that? Just Joan Gallardo!!! I got a 100% financing thanks to Joan. Thanks to Joan my family and I have a place to call a HOME. I recommend everyone to contact JOAN GALLARDO! You will NOT regret it. Thank you Joan!!

-

Cassandra Beasley • November 14, 2024

Thank you, Joan & Patricia, for making my dreams come true as a first-time new homeowner. The hard work and communication through the process made my home buying easy experience. They have an exceptional team that works hand in hand and closed my loan on time!!! trusting and I learned so much from them during the process. I definitely refer Clear Lending and look forward to working with them again in the future!