Préstamos hipotecarios para altas tasas de endeudamiento

¿Le resulta difícil completar la compra de una casa debido a una deuda alta? ¿Su banco recientemente los privó a usted y a su familia de comprar esa casa perfecta debido a deudas superpuestas o problemas financieros pasados? Si las respuestas a estas preguntas son SÍ, es posible que deba buscar un préstamo hipotecario con deuda alta.

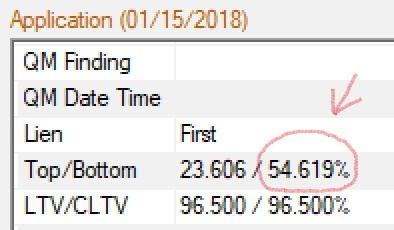

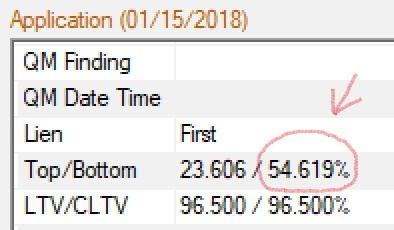

La relación deuda/ingresos indica qué porcentaje de tus ingresos está pagando tu deuda cada mes. La alta proporción de deuda a ingreso significa que una gran parte de su ingreso se destina a pagar sus deudas cada mes, mientras que una proporción más pequeña significa que una porción menor de su ingreso se gasta en el pago de deudas.

Aquellos que planean comprar una casa encontrarán que la aprobación de préstamos hipotecarios para altas tasas de deuda está casi fuera de alcance. A continuación, compartiremos 3 consejos que lo ayudarán a calificar para préstamos hipotecarios por una alta proporción de deuda. Sin embargo, es importante recordar que cada prestamista tiene sus propios requisitos de préstamo diferentes, también llamados superposiciones, por lo que cada uno analizará la relación deuda-ingreso del solicitante de manera diferente.

Para aumentar sus posibilidades de calificar para un préstamo hipotecario, echemos un vistazo a cómo puede superar su relación deuda / ingreso y calificar para comprar la casa de sus sueños:

1. Crea un plan - A menos que tenga una necesidad urgente de comprar una casa y no pueda esperar, le sugerimos que se contacte primero con nosotros para aconsejar sobre qué cuentas debe invertir primero para reducir su índice de deuda. Creíble o no, hace la diferencia la orden de pagar préstamos estudiantiles, tarjetas de crédito, pagos de automóviles, muebles o cualquier otro tipo de préstamos ya sea en cuotas o cuentas renovables. En un escenario ideal, tener un índice de deuda por debajo del 36% puede aumentar sus posibilidades de calificar para un préstamo hipotecario, pero hemos aprobado más del 50%.

2. Incremento del anticipo - Aunque pagar un pago inicial grande podría no ser una opción viable para algunos solicitantes, es algo que, de ser posible, sugerimos. Los compradores con IRAs u otras cuentas de jubilación deben considerar los ahorros en intereses y el gasto de PMI frente al aumento en el valor de dichos activos. No solo puede ser una buena inversión, sino también mostrarle al prestamista la seriedad de su decisión de comprar una casa e indicar su compromiso con la inversión, aumentando así sus posibilidades de calificar para préstamos hipotecarios por una alta proporción de deuda.

3. Asistencia del Gobierno - Si encuentra que los préstamos hipotecarios para altas tasas de deuda no son una opción disponible para usted con prestamistas privados, entonces recurrir a los programas gubernamentales de préstamos hipotecarios es la mejor opción para usted. Estos programas de préstamos hipotecarios fueron diseñados y desarrollados por el gobierno para promover la propiedad de vivienda al proporcionar asistencia financiera a aquellos que no pueden comprar una casa a través de otros medios debido a la falta de disponibilidad financiera o un buen historial crediticio.

Creado por la Administración Federal de la Vivienda, el préstamo hipotecario FHA es emitido por prestamistas aprobados por la FHA y proporciona los siguientes beneficios:

• Los préstamos de la FHA permiten que el prestatario obtenga la aprobación para el préstamo hipotecario a pesar del alto índice de deuda.

• Puede comprar una casa con un pago inicial tan bajo como el 3.5%.

• Hay un seguro hipotecario más bajo con un préstamo de la FHA.

• La FHA brinda mejores tasas de interés en comparación con otros préstamos hipotecarios.

En Clear Lending, llevaremos a cabo un análisis gratuito de sus ratios que lo ayudará a comprender sus posibilidades de calificar para préstamos hipotecarios por razones de deuda elevadas. Simplemente contáctenos y lo ayudaremos con el mejor plan para comprar la casa de sus sueños.

No esperes más y descubra hoy por cuánto puede pre-aprobar.

If you are thinking about buying or refinancing your mortgage loan, Clear Lending can help you. Simply submit our Pre-Approval Form and we will contact you immediately to review the best options for you.

This ad is not an offer for a credit extension. Programs available only to qualified borrowers. Programs subject to change without prior notice. Terms and conditions of subscription apply. Some restrictions may apply.

Comentarios de clientes:

-

Nandi Gregori • Agosto 03, 2020

Would recommend 1000%!!!!! What an experience! Called Joan about buying a home and within 2 months, we looked at A LOT of homes, found one we loved, and closed within 30 days. Before calling Clear lending, I was stressed about the home buying process due to the COVID virus, never thought we would be able to close during a pandemic. Joan made the home buying experience simple and straightforward, answering all questions via phone and WhatsApp, and we also made sure to send all needed documentation in, when requested, to ensure a smooth close... The closing process was stressful due to the anticipation of wanting the process to come to an end, however, that's normal and Joan was readily available answering my never-ending questions. Joan truly cares about his clients and was in my corner throughout the process. Superexcellent home buying experience and a great person to work with. Thanks, Joan/clear lending!!!!

-

Amelie Guzman • Octubre 10, 2021

Thanks Joan, Patricia and Jorge for helping us to buy our first home. You all are kind, knowledgeable and very professional. Even thgough we were referred to you guys and so we were told you were amazing, my husband and I are happy to confirm you are everything our friends already told us about working with Clear Lending. We will use you again for an investment house we have soon in mind. Thanks again for your hard work.

-

Nandi Dhungel • Diciembre 29, 2020

We visited Clear Lending after we got an appointment today and we submitted the docs they had wanted. Our docs were reviewed and we were advised that we could not be approved due to our present income status. The Clear Lending staff told us what we need to do afterward and we were fully satisfied with their convincing advice. And we are convinced to go with Clear Lending in the loan process in the later days.